Creating a budget doesn’t have to be overwhelming or complicated. The 50/30/20 rule offers a simple yet powerful framework for managing your money effectively, helping you balance current expenses with future financial security. This time-tested approach can transform your relationship with money by providing clear guidelines for spending and saving.

What is the 50/30/20 Rule?

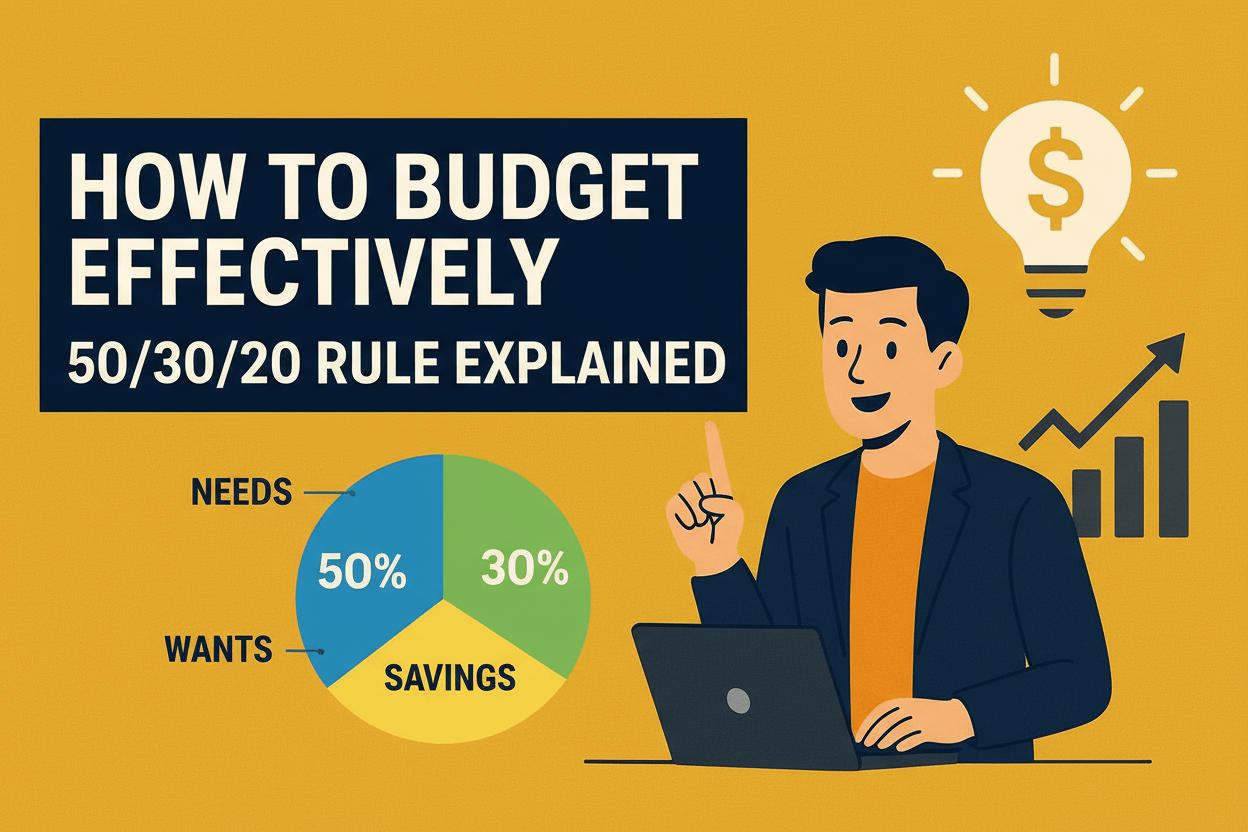

The 50/30/20 rule is a straightforward budgeting method that divides your after-tax income into three essential categories. Originally popularized by Harvard bankruptcy expert Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan,” this framework allocates your monthly income as follows:

50% for Needs: Essential expenses you cannot avoid, such as rent, groceries, utilities, insurance, and minimum debt payments.

30% for Wants: Discretionary spending on lifestyle choices like dining out, entertainment, shopping, and hobbies.

20% for Savings and Debt Repayment: Emergency funds, retirement contributions, investments, and extra debt payments beyond minimums.

This approach provides structure while maintaining flexibility, making it an ideal starting point for both budgeting beginners and experienced money managers seeking simplification.

Breaking Down Each Category

The 50% Needs Category

Your needs represent the non-negotiable expenses required for basic living and financial obligations. These typically include:

- Rent or mortgage payments

- Utilities (electricity, water, gas, internet, phone)

- Groceries and basic household items

- Transportation costs (car payments, gas, public transit)

- Insurance premiums (health, auto, life)

- Minimum required debt payments

- Childcare expenses necessary for work

If your needs exceed 50% of your income, it’s a signal that lifestyle adjustments may be necessary. Consider downsizing your living situation, exploring more affordable transportation options, or reviewing recurring subscriptions and services.

The 30% Wants Category

The wants category covers expenses that enhance your lifestyle but aren’t essential for survival. This includes:

- Dining out and takeaway meals

- Entertainment and streaming subscriptions

- Shopping for non-essential items

- Hobbies and recreational activities

- Gym memberships and fitness classes

- Travel and vacations

- Personal grooming and beauty services

The key is distinguishing between needs and wants, which can sometimes be challenging. For instance, groceries are a need, but premium organic products might fall into the wants category if they significantly increase your food budget.

The 20% Savings and Investments Category

This crucial category focuses on your financial future and includes:

- Emergency fund contributions (aim for 3-6 months of expenses)

- Retirement savings (401(k), IRA contributions)

- Investment accounts and wealth building

- Additional debt payments beyond minimums

- Short-term savings for specific goals (vacation, home down payment)

Consistently allocating 20% to this category helps build long-term financial security and creates a buffer for unexpected expenses.

Real-World Example: Applying the 50/30/20 Rule

Let’s examine how someone earning ₹80,000 monthly after taxes might implement this budgeting approach:

Monthly Income: ₹80,000

Needs (50% = ₹40,000):

- Rent: ₹20,000

- Utilities: ₹5,000

- Groceries: ₹8,000

- Transportation: ₹5,000

- Insurance: ₹2,000

Wants (30% = ₹24,000):

- Dining out: ₹5,000

- Entertainment: ₹4,000

- Hobbies: ₹3,000

- Subscriptions: ₹2,000

- Vacation fund: ₹10,000

Savings (20% = ₹16,000):

- Emergency fund: ₹10,000

- Retirement savings: ₹4,000

- Investment account: ₹2,000

This breakdown demonstrates how the rule creates a balanced approach to money management while ensuring consistent progress toward financial goals.

Benefits of the 50/30/20 Rule

Simplicity and Ease of Use

The rule’s three-category structure eliminates the complexity of tracking multiple budget categories. You can quickly categorize expenses without intricate calculations, making it accessible even for those with limited financial experience.

Balanced Approach to Money Management

Unlike restrictive budgets that can feel overwhelming, the 50/30/20 rule acknowledges that enjoying your money today is important while still prioritizing future financial security. This balance makes it more sustainable long-term.

Emphasis on Savings

By dedicating 20% of income to savings and investments, the rule ensures consistent progress toward financial goals. This systematic approach helps build wealth over time and provides security for unexpected expenses.

Flexibility Within Structure

While providing clear guidelines, the rule allows for adjustments based on personal circumstances. You can modify percentages to fit your specific situation while maintaining the overall framework.

When the 50/30/20 Rule May Not Work

Despite its popularity, the 50/30/20 rule isn’t suitable for everyone. Several situations may require modifications or alternative approaches:

Low Income Situations

If your income is limited relative to your area’s cost of living, essential expenses may exceed 50% of your income. In high-cost cities, housing alone might consume nearly half your budget, leaving little room for the prescribed allocations.

High Income Scenarios

High earners might find the 20% savings rate insufficient for optimal wealth building. Someone with significant discretionary income could potentially save 40-60% without compromising their quality of life.

High Debt Burdens

Individuals with substantial debt may need to allocate more than 20% toward debt repayment to achieve financial stability more quickly. In such cases, temporarily reducing the wants category might be necessary.

Variable Income

Freelancers, commission-based workers, or those with irregular income may find the fixed percentages challenging to maintain consistently.

Alternative Budgeting Approaches

If the 50/30/20 rule doesn’t fit your circumstances, consider these alternatives:

The 70/20/10 Rule

- 70% for living expenses (needs and wants combined)

- 20% for savings and investments

- 10% for debt repayment or charitable giving

Zero-Based Budgeting

Every dollar is assigned a specific purpose, ensuring no money remains unallocated. This detailed approach works well for those who prefer comprehensive expense tracking.

Pay Yourself First

Prioritize savings by automatically transferring a predetermined amount to savings accounts before spending on anything else. The remainder can be spent freely.

The 60/40 Rule

For those in high-cost areas or with substantial debt:

- 60% for needs

- 20% for wants

- 20% for savings and debt repayment

Implementing the 50/30/20 Rule: Step-by-Step Guide

Step 1: Calculate Your After-Tax Income

Start by determining your monthly take-home pay after taxes and mandatory deductions. This is your baseline for the 50/30/20 calculations.

Step 2: Track Your Current Spending

Monitor your expenses for 2-3 months to understand your current spending patterns. Use bank statements, credit card records, or budgeting apps to categorize your expenditures.

Step 3: Categorize Your Expenses

Sort your expenses into needs, wants, and savings/debt payments. Be honest about what constitutes a true need versus a want.

Step 4: Calculate Your Target Allocations

Multiply your after-tax income by 0.50, 0.30, and 0.20 to determine your target spending for each category.

Step 5: Make Necessary Adjustments

If your current spending doesn’t align with the 50/30/20 targets, identify areas where you can reduce expenses or increase income.

Step 6: Automate Your Savings

Set up automatic transfers to savings and investment accounts to ensure consistent progress toward your financial goals.

Step 7: Review and Adjust Regularly

Periodically review your budget and make adjustments as your income, expenses, or financial goals change.

Tips for Success with the 50/30/20 Rule

Start Small: If you’re new to budgeting, begin by focusing on one category at a time rather than trying to perfect all three simultaneously.

Use Technology: Leverage budgeting apps and automatic savings features to simplify implementation and tracking.

Be Realistic: Adjust the percentages if necessary to fit your circumstances. A modified version that you can stick to is better than abandoning budgeting altogether.

Review Regularly: Your budget should evolve with your life circumstances. Regular reviews ensure it remains relevant and effective.

Focus on Progress, Not Perfection: Don’t abandon your budget if you occasionally overspend in one category. The goal is overall financial improvement, not perfect adherence.

Customizing the Rule for Different Life Stages

Young Professionals

May need to allocate more to debt repayment for student loans while building emergency funds.

Families with Children

Might require higher allocation for needs due to childcare, education, and healthcare expenses.

Pre-Retirement

Should consider increasing savings percentage to catch up on retirement goals if necessary.

High-Income Earners

Can potentially save more than 20% while maintaining a comfortable lifestyle.

The 50/30/20 rule provides an excellent foundation for effective budgeting, offering simplicity, balance, and a clear path toward financial wellness. While it may require adjustments based on individual circumstances, its core principle of balanced spending and consistent saving remains valuable for most people seeking better money management. Remember that the best budget is one you can maintain consistently, so don’t hesitate to modify the percentages to fit your unique financial situation and goals.